Artificial Intelligence in Trading Strategies Ultimate Guide

7 September, 2023

Artificial Intelligence (AI) is transforming financial markets. Institutional investors are harnessing AI trading strategies to maximize market gains. These strategies leverage AI's rapid and precise data analysis capabilities.

AI trading strategies involve computer algorithms and software analyzing market data. These algorithms use machine learning to spot market patterns and predict future price movements. Trades are then executed based on these predictions.

AI swiftly processes vast data volumes. It identifies patterns and trends, providing a competitive edge in trading.

What is AI Trading?

AI trading, in short, involves using computer programs to analyze market data and make trades. These programs leverage AI technologies like machine learning, natural language processing, and computer vision to predict market trends and find profitable trades.

Smart Scanning for Profits.

AI trading employs smart computers that scan vast data sets to uncover profitable trading opportunities. While not a new concept, these computers have become smarter and faster over time, enhancing their power.

The Power of Algorithms.

AI trading relies on computer algorithms trained through machine learning. These algorithms identify patterns and trends in market data, enabling predictions about future price movements. They can also execute trades automatically based on specific conditions, a process known as algorithmic trading.

Why AI Trading is Trending.

AI trading has gained popularity due to its ability to process large data volumes and make highly accurate predictions.

Proceed with Caution.

It’s crucial to assess the performance and track record of AI trading systems before using them, as they carry risks. In the wrong hands, these strategies can be detrimental.

Jim Simons and his Medallion Fund are notable figures who have long embraced AI in trading.

Benefits of Artificial Intelligence Trading

Artificial Intelligence (AI) trading offers numerous advantages, including:

- Enhanced Efficiency

AI trading systems rapidly analyze vast data sets, enabling traders to make quicker and more informed decisions. Tasks that once took weeks or months now take mere minutes and seconds. - Improved Accuracy

AI algorithms excel at identifying market patterns and trends that elude human detection. This boosts prediction accuracy and enhances the likelihood of profitable trades. - Automated Trading

AI trading systems can be programmed to execute trades automatically based on preset conditions or parameters. This reduces the need for human intervention and results in faster and more consistent trade execution. - Reduced Emotional Bias

AI trading systems remain impervious to emotional biases, leading to better decision-making and improved risk management. Emotional bias is a primary factor in many traders' failures or underperformance. - Continuous Learning

AI trading systems continually learn and adapt to changing market conditions, refining their performance and predictive abilities over time. This ongoing feedback loop ensures constant improvement.

Understanding the Risks of Artificial Intelligence Trading

Artificial Intelligence (AI) trading presents certain risks that need attention:

- Lack of Transparency

Some AI trading systems employ complex and opaque algorithms, making it challenging to assess their performance or understand the associated risks. This complexity can lead to overfitting issues when too many variables are involved. - Data Bias and Overfitting

The quality of AI trading systems heavily relies on the data they are trained on. If the data is biased, the system will be biased as well. Overfitting can occur when the system is trained on specific data that doesn't adapt well to new market conditions, resulting in poor performance. A robust strategy should account for different market scenarios, including bull and bear markets. - Lack of Human Oversight

AI trading systems follow predefined rules, which may not consider unforeseen market events or the need for human intervention. - Dependence on Technology

AI trading systems rely on technology and internet connectivity. Technical glitches or cyber-attacks can disrupt their operations, leading to potential losses. - Technical Mistakes

Errors, including "fat-finger" mistakes, can happen, and computer systems are susceptible to unknown risks. Vigilance is necessary to prevent such issues.

Exploring Artificial Intelligence Trading Strategies

Discover various types of Artificial Intelligence (AI) trading strategies:

- Unsupervised Learning

Key Idea: Utilizes unlabeled data to uncover hidden patterns or structures. Ideal for spotting market anomalies. - Supervised Learning

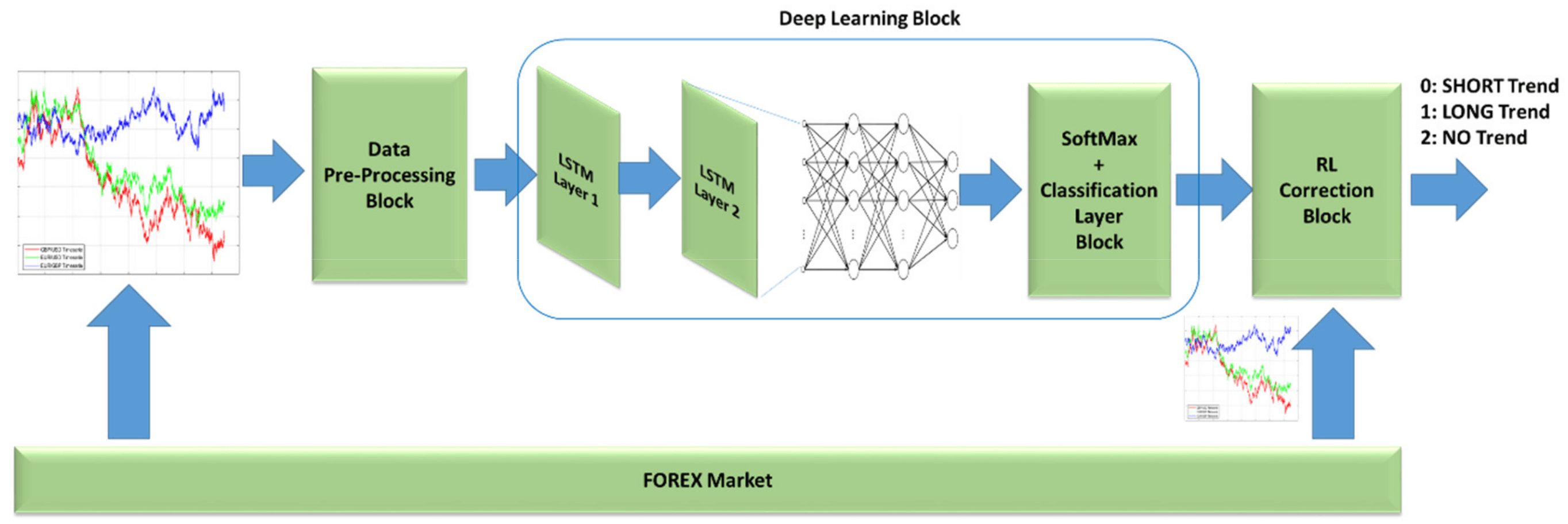

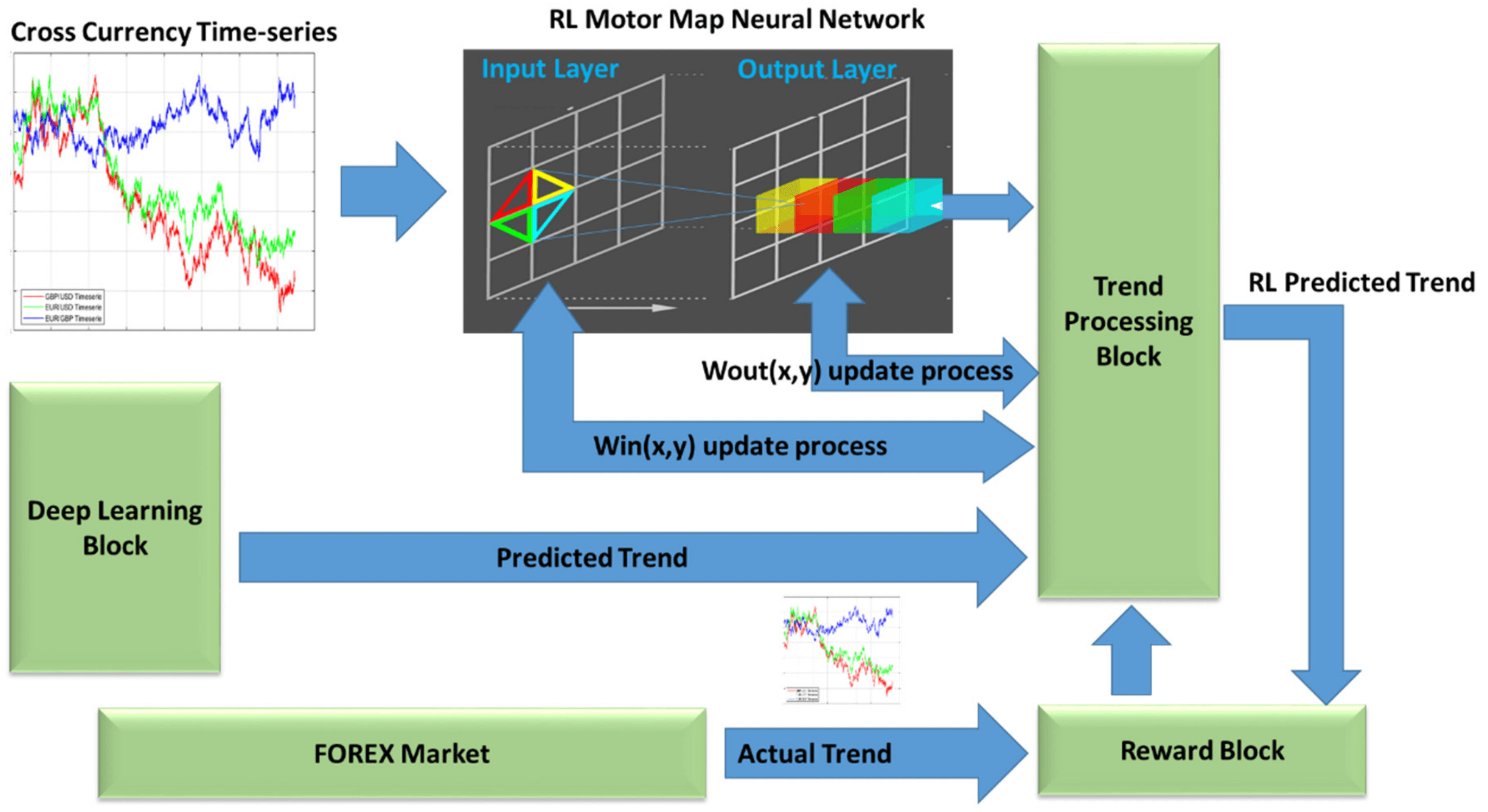

Key Idea: Relies on labeled data to predict outcomes based on input. Useful for forecasting asset prices. - Reinforcement Learning

Key Idea: Employs trial and error for algorithm learning, with rewards or penalties based on outcomes. Great for adaptive trading bots. - Deep Learning

Key Idea: Utilizes neural networks to learn, store, and compare data for future pattern recognition. - Hybrid Strategies

Key Idea: Combines various AI approaches to achieve superior results compared to using a single strategy.

Understanding Market Analysis in Artificial Intelligence Trading

AI systems employ various market analysis approaches, including:

- Fundamental Analysis

Key Focus: Examines macroeconomic, financial, and asset-specific factors impacting value, including financial statements and economic data. Resembles factor investing. - Technical Analysis

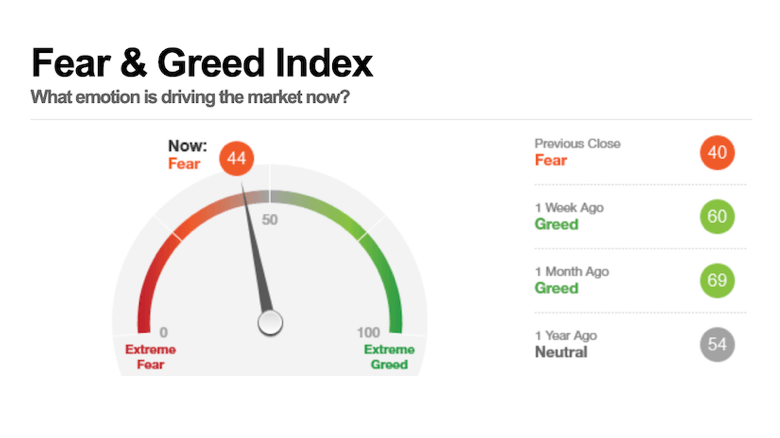

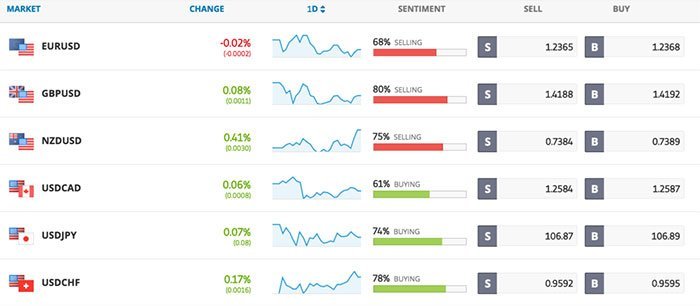

Key Focus: Analyzes historical market data (e.g., prices and trading volumes) to identify market patterns and trends. Utilizes technical indicators like moving averages and RSI. - Sentiment Analysis

Key Focus: Utilizes natural language processing (NLP) to assess sentiment in news articles, social media, and text data. Gauges overall attitude toward assets or markets. - Hybrid Analysis

Key Approach: Combines multiple analysis types (e.g., technical and fundamental) to gain a comprehensive market perspective. - Predictive Modeling

Key Approach: Employs machine learning algorithms to predict future market movements based on historical data. Utilizes supervised, unsupervised, or reinforcement learning techniques for real-time market analysis.

AI Trading Strategies Across Markets

Artificial Intelligence (AI) trading strategies find applications in various markets:

- Stock Market

Focus: Analyze financial statements, economic data, and company-specific information to predict future stock prices. - Commodities Market

Focus: Analyze supply and demand, weather patterns, and factors influencing commodities like oil, gold, and agricultural products. - Financial Derivatives Market

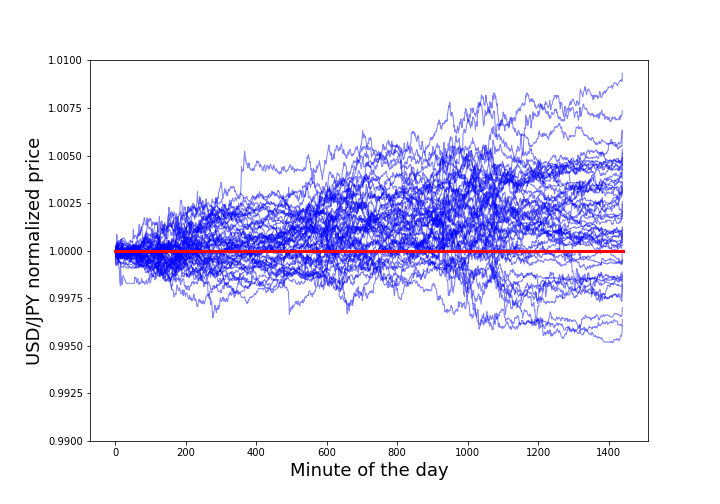

Focus: Analyze market data to predict options and futures contract prices. - Forex Market

Focus: Analyze economic indicators, political developments, and factors affecting currency exchange rates. Note: Forex trading is challenging. - Cryptocurrency Market

Focus: Analyze blockchain data, social media sentiment, and factors impacting cryptocurrency prices, such as Bitcoin and Ethereum.

Different markets possess unique characteristics, requiring tailored AI strategies. Data and features used for AI model training vary by market.

Popular Artificial Intelligence Trading Strategies

In financial markets, several popular Artificial Intelligence (AI) trading strategies stand out:

- Algorithmic Trading

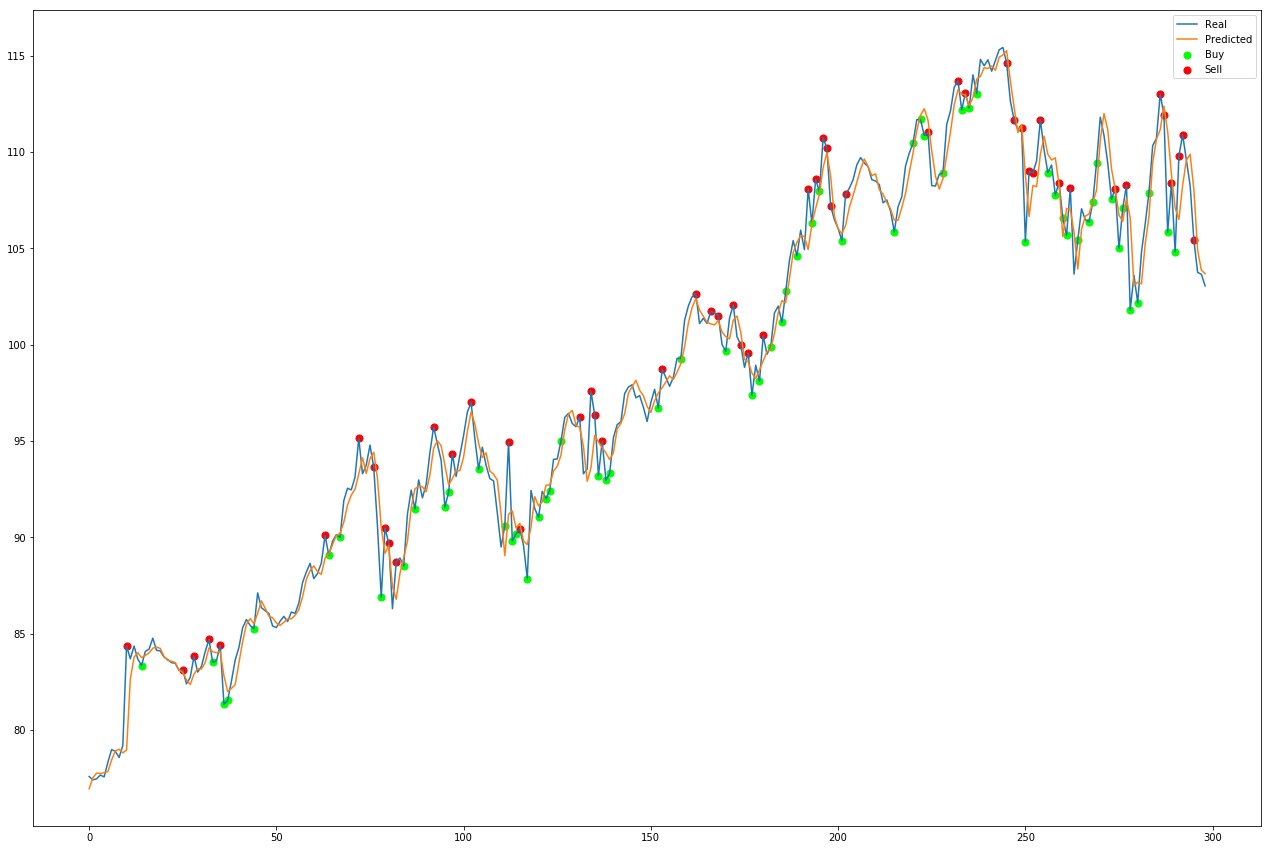

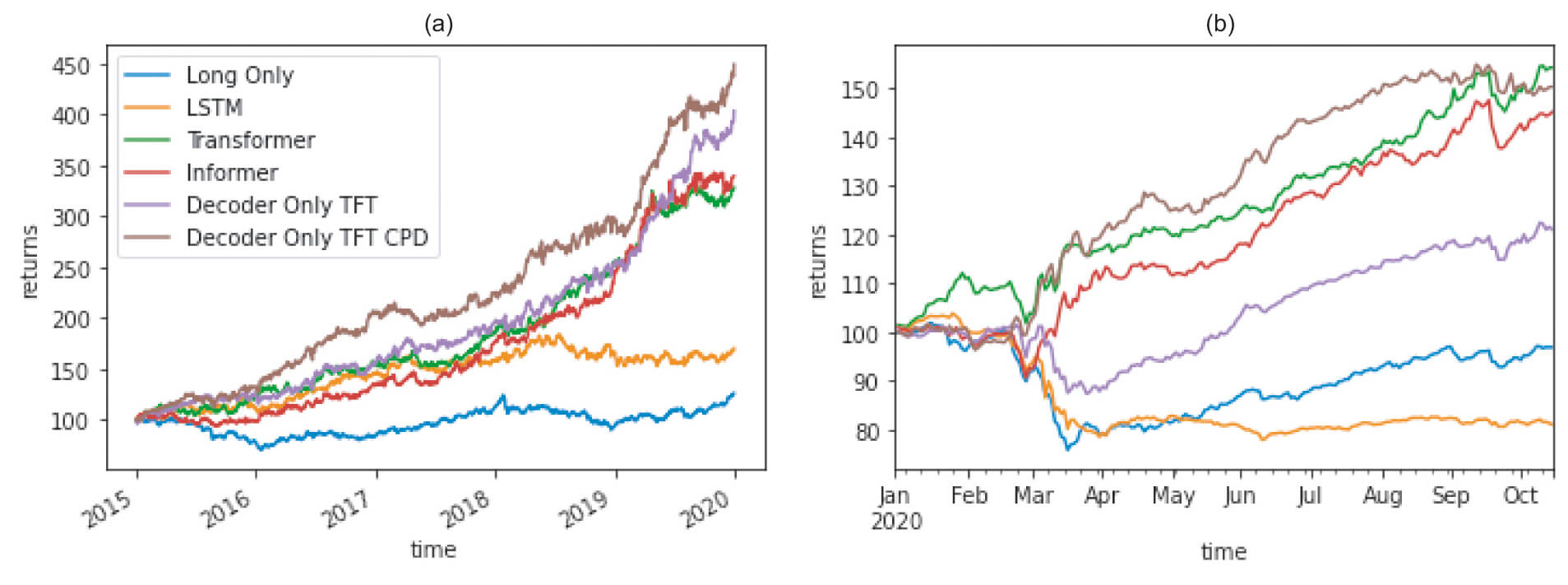

Key Approach: Uses computer algorithms to automatically execute trades based on preset conditions or parameters. Includes strategies like market-making, statistical arbitrage, and high-frequency trading (not suitable for retail traders). - Machine Learning-Based Prediction

Key Approach: Utilizes machine learning algorithms for predicting future market movements. Methods include supervised learning (e.g., linear regression, decision trees) and unsupervised learning (e.g., clustering, dimensionality reduction). - Deep Learning-Based Prediction

Key Approach: Deploys deep neural networks, including convolutional neural networks (CNN) and recurrent neural networks (RNN), to forecast future market movements. Ideal for image and sequence data analysis. - Natural Language Processing-Based Sentiment Strategy

Key Approach: Utilizes natural language processing (NLP) techniques to analyze news articles, social media content, and text data to assess overall sentiment and attitude toward specific assets or markets.

Steps to Create an AI Trading Strategy

Developing an Artificial Intelligence (AI) trading strategy involves several key steps:

- Define the Problem

Objective: Clearly outline the problem your AI strategy will address, such as predicting future stock prices or identifying profitable trading opportunities. - Collect and Preprocess Data

Objective: Gather and clean market data, including historical prices, trading volumes, and financial indicators, to prepare it for model training. - Choose a Model

Objective: Select the AI model best suited for your specific problem. Options include supervised learning techniques like linear regression or decision trees, or unsupervised methods such as clustering or dimensionality reduction. - Train the Model

Objective: Use the collected and preprocessed data to train your chosen AI model. Fine-tune hyperparameters if needed for optimal performance. - Validate the Model

Objective: Assess the model's performance using a validation set. This step often involves backtesting the model on historical data and comparing its performance against a benchmark. - Implement the Model

Objective: Incorporate the trained model into a trading system. Utilize it to execute trades or generate trading signals. - Monitor and Evaluate Performance

Objective: Continuously monitor the model's performance in real-world trading conditions. Make necessary adjustments to ensure its effectiveness over time.

Advantages of Automating AI Trading Strategies

Automating AI trading strategies offers several advantages:

- Rapid Data Analysis

AI systems excel at analyzing vast amounts of data quickly, enabling informed decision-making. - Reduced Emotional Bias

Automation minimizes the impact of emotional biases, leading to more objective trading decisions. - Consistency and Timeliness

AI systems execute trades consistently and promptly, reducing the potential for human errors and mistakes. - Continuous Monitoring and Risk Management

Automated systems monitor market conditions continuously, adjusting trades as needed to improve risk management. - Scalability

AI enhances scalability by efficiently handling large data volumes and executing trades at high speeds.

Disadvantages of Automating AI Trading Strategies

However, there are also disadvantages to automating AI trading strategies:

- Data Dependency

AI strategies rely on the quality of training data; poor data quality can result in subpar performance. - Technology Reliance

AI trading systems depend on technology and internet connectivity, making them vulnerable to technical issues and cyberattacks. - Lack of Human Oversight

Without human supervision, significant losses can occur when automated systems malfunction or misinterpret market conditions.

Testing Artificial Intelligence Trading Strategies

Artificial Intelligence (AI) trading strategies can undergo various testing methods:

- Backtesting

Method: Evaluate AI model performance on historical market data. - Forward Testing

Method: Assess AI model performance in real-world conditions using live market data. - Walk-Forward Testing

Method: Test the AI model on historical data, then retrain it with updated data and test on newer data. - Out-of-Sample Testing

Method: Evaluate AI model on historical data it has not encountered before. - Incubation

Method: Temporarily hold the strategy and assess its performance after at least 12 months. - Monte Carlo Simulation

Method: Statistically assess model robustness by simulating diverse market scenarios.

Latest Developments in AI Trading Strategies

Recent advancements in AI trading strategies include:

- Generative Adversarial Networks (GANs)

Application: Generating new data samples for AI models. - Evolutionary Algorithms

Application: Optimizing AI model parameters. - Reinforcement Learning

Application: Training agents to make decisions through trial-and-error. - Explainable AI (XAI)

Application: Enhancing transparency and interpretability in AI models. - Transfer Learning

Application: Applying a model trained on one task to a related task. - Multi-Agent Systems

Application: Coordination among multiple agents to achieve common goals.

Conclusion

Artificial Intelligence (AI) trading strategies have emerged as powerful tools in the financial markets, offering the potential to enhance decision-making, minimize emotional biases, and optimize trading outcomes.

Recent developments in AI, including GANs, evolutionary algorithms, and explainable AI, continue to shape the landscape of trading strategies, enabling traders and investors to adapt to evolving market dynamics.

As the field of AI trading strategies evolves, it is imperative for practitioners to stay informed and embrace these advancements to stay competitive in the ever-changing financial world.